How to Leverage DeFi for Passive Income

How to Leverage DeFi Platforms to Generate Sustainable Passive Income is your guide to unlocking the potential of Decentralized Finance. Discover how you can harness the power of DeFi platforms to earn passive income streams. We’ll explore various mechanisms, from yield farming to staking, and analyze different platforms to help you find the right fit. Understanding the inherent risks and implementing robust mitigation strategies is crucial, so we’ll also delve into risk assessment and effective strategies to optimize your passive income generation.

This comprehensive guide will equip you with the knowledge and strategies to navigate the dynamic world of DeFi and achieve sustainable passive income. We’ll look at specific platforms, analyze their features, and discuss the best approaches to maximizing your returns while minimizing risks.

Introduction to DeFi and Passive Income

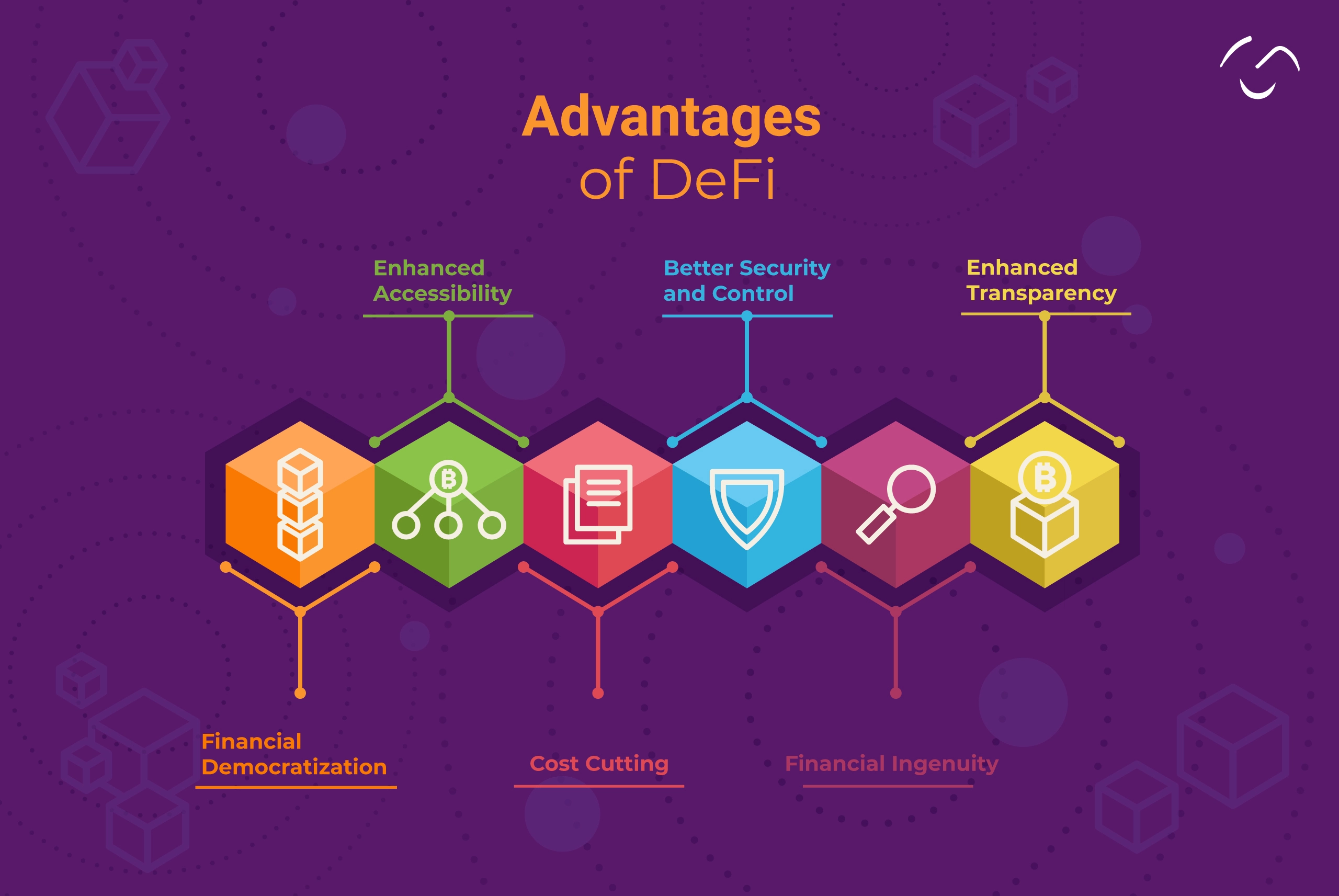

Decentralized Finance (DeFi) is revolutionizing the financial industry by offering innovative financial services without relying on intermediaries like banks. This removes traditional barriers to entry and access, potentially democratizing access to financial tools and opportunities. DeFi platforms use blockchain technology to create transparent and secure financial applications. Passive income, in contrast, involves generating revenue with minimal ongoing effort.

Looking for ways to generate passive income? DeFi platforms offer exciting possibilities, but fluctuating interest rates can make things tricky. President Donald Trump says he’ll ‘demand that interest rates drop immediately’ here , which could potentially impact the returns on your DeFi investments. However, savvy investors can still leverage these platforms to create sustainable passive income streams, even with unpredictable market conditions.

Careful research and diversification are key to weathering these storms and achieving consistent returns.

The intersection of DeFi and passive income presents exciting opportunities for individuals seeking to build wealth while maintaining a degree of freedom and flexibility. The key lies in identifying and utilizing suitable DeFi platforms that align with one’s investment goals and risk tolerance.

Understanding Passive Income in DeFi

Passive income, in its simplest form, is revenue generated with little to no active involvement. In the context of DeFi, this involves leveraging smart contracts and automated processes to earn returns on investments. These returns can take various forms, such as staking rewards, yield farming, or lending interest. The key is to find strategies that generate consistent returns with minimal ongoing management.

Examples of DeFi Platforms for Passive Income

Various DeFi platforms cater to passive income generation. These platforms often employ different mechanisms for achieving this. Some facilitate lending and borrowing, while others focus on staking or liquidity provision. The choice of platform should depend on individual risk tolerance and investment goals.

Key Features of DeFi Platforms for Passive Income

| Platform | Investment Type | Return Mechanism | Risk Assessment |

|---|---|---|---|

| Aave | Lending and borrowing of crypto assets | Interest earned on deposited assets, or interest paid on borrowed assets | Moderate risk, associated with potential market fluctuations and platform vulnerabilities. Users should carefully assess the creditworthiness of borrowers before lending. |

| Compound | Lending and borrowing of crypto assets, algorithmic lending | Interest earned on deposited assets, interest paid on borrowed assets | Moderate risk, associated with market volatility and potential platform exploits. Thorough due diligence on the platform’s security is critical. |

| Curve Finance | Liquidity provision on stablecoin pools | Fees earned from providing liquidity in the pool | Moderate risk, associated with impermanent loss (changes in the relative value of assets in a pool) and potential platform exploits. |

| SushiSwap | Liquidity provision on various cryptocurrency pools | Fees earned from providing liquidity in the pool | Moderate risk, associated with impermanent loss and potential platform exploits. Users should thoroughly understand the risks involved. |

These examples showcase the diversity of DeFi platforms, each offering distinct approaches to generating passive income. Careful consideration of each platform’s investment type, return mechanism, and associated risk is essential for making informed decisions. A well-researched strategy is crucial for mitigating potential risks and maximizing returns.

Understanding DeFi Mechanisms for Passive Income

Decentralized finance (DeFi) offers a novel approach to generating passive income, leveraging smart contracts and blockchain technology. This section dives into the various DeFi mechanisms enabling passive income, examining yield farming, staking, and liquidity provision. We’ll also compare different DeFi protocols, highlighting their strengths and weaknesses.Different DeFi mechanisms empower users to earn passive income without relying on intermediaries.

By participating in these protocols, individuals can potentially generate returns based on their contributions to the platform’s liquidity and overall network health.

Yield Farming Strategies for Passive Income

Yield farming involves lending or providing liquidity to decentralized finance (DeFi) protocols in exchange for yield-bearing tokens. Strategies often involve identifying opportunities to maximize returns while managing risk. The strategies are often complex, requiring a deep understanding of the protocols and market dynamics.

- Identifying Opportunities: Yield farming involves strategically selecting DeFi protocols and tokens with the potential for high returns. This requires careful research and analysis of market trends, project fundamentals, and community activity. For instance, a token with a strong community and positive development roadmap may offer better potential rewards.

- Risk Management: Yield farming strategies inherently carry risks. Impermanent loss, protocol vulnerabilities, and market fluctuations can all negatively impact returns. Understanding the risk associated with each strategy is crucial to minimizing potential losses.

- Portfolio Diversification: Diversifying across various yield farming opportunities can mitigate risk and maximize returns. This involves strategically allocating capital to different protocols and tokens, spreading the risk across various investment options.

Staking for Passive Income

Staking involves locking up cryptocurrency in a DeFi protocol in exchange for rewards. The rewards are typically in the form of additional tokens or transaction fees. Staking can be a low-risk passive income approach for many users.

- Staking Rewards: The rewards earned from staking typically depend on the amount of cryptocurrency staked and the chosen protocol. Some protocols offer fixed APY (Annual Percentage Yield) rates, while others may have variable rates based on network demand.

- Security Considerations: Users should carefully select reputable staking platforms to minimize the risk of security breaches or platform failures. Thorough due diligence on the platform’s security measures is critical.

- Lock-up Periods: Staking often involves lock-up periods, which can limit the flexibility of using the staked assets during that time. The lock-up period varies among different staking protocols.

Liquidity Provision for Passive Income

Liquidity provision involves providing liquidity to a decentralized exchange (DEX) or other DeFi protocol in exchange for a share of the trading fees or other rewards. This provides liquidity to the platform and generates passive income.

- Impermanent Loss: Liquidity provision involves a trade-off between the value of the assets in the pool and the proportion of each asset in the pool. This can lead to a situation where the combined value of the assets decreases over time, known as impermanent loss. Understanding this potential loss is crucial.

- Liquidity Pool Composition: The composition of the liquidity pool impacts the returns earned. The choice of tokens and their relative proportions affects the trading volume and, subsequently, the rewards generated.

- Liquidity Pool Stability: Maintaining the stability of the liquidity pool is important for maximizing returns. The price volatility of the tokens in the pool can affect the stability of the pool, impacting potential returns.

Comparison of DeFi Protocols for Passive Income

Different DeFi protocols offer varying passive income opportunities. These protocols often cater to specific needs and risk tolerances. Factors such as security, liquidity, and community support play a role in the choice of protocol.

| Mechanism | Pros | Cons |

|---|---|---|

| Yield Farming | Potentially high returns, diverse opportunities | High risk of impermanent loss, complex strategies |

| Staking | Generally lower risk, straightforward participation | Potentially lower returns compared to yield farming, lock-up periods |

| Liquidity Provision | Earn trading fees, contribute to market liquidity | Impermanent loss, market volatility, potential for significant losses |

Selecting Suitable DeFi Platforms

Source: ytimg.com

Choosing the right DeFi platform is crucial for generating sustainable passive income. A poorly selected platform can lead to significant financial losses due to security breaches, poor user experience, or simply lack of suitable investment options. Careful consideration of various factors, including platform security, reputation, user interface, and available investment opportunities, is essential for success.A well-researched and thoughtfully selected DeFi platform will provide a stable and secure environment for generating passive income, while a poorly chosen one can lead to significant losses.

Therefore, understanding the key characteristics and criteria for evaluating DeFi platforms is paramount.

Platform Security and Reputation

Platform security is paramount. DeFi platforms, like any financial institution, are susceptible to hacks and exploits. Reputable platforms employ robust security measures, including multi-factor authentication, advanced encryption, and regular security audits. A platform’s security history and the reputation of its developers and team are key indicators of its trustworthiness. A thorough investigation into past security incidents and any public concerns is vital.

Users should also scrutinize the platform’s security protocols, and check for certifications or compliance with industry standards.

Platform User Interface and Ease of Use

A user-friendly interface is essential for navigating a DeFi platform effectively. A complex or confusing interface can lead to errors and frustration, potentially resulting in financial losses. The platform should offer clear instructions and intuitive tools. The ease of use greatly impacts the overall user experience and reduces the risk of errors. An intuitive interface allows users to quickly access the functionalities and investment options available, while a complex interface may deter users from using the platform and generate losses.

Researching Different Platforms

Thorough research is essential before selecting a DeFi platform. Numerous platforms offer a wide array of investment options and functionalities. It is crucial to compare various platforms based on their security measures, user interface, fees, and investment options. This comparison should also include an evaluation of the platform’s community, developer activity, and any potential regulatory risks. Conducting due diligence is critical for long-term success.

Summary of Selection Criteria

| Criteria | Description | Importance |

|---|---|---|

| Security | Robust security measures, including encryption, multi-factor authentication, and regular audits. Thorough investigation into past security incidents and public concerns. | Critical for protecting funds and preventing losses. A platform with a proven track record of security is essential. |

| Reputation | The platform’s history, developer team’s experience, and community feedback. Checking for any public concerns, certifications, and compliance with industry standards. | Provides an indication of the platform’s trustworthiness and reliability. A platform with a strong reputation is more likely to be secure and stable. |

| User Interface | Intuitive and user-friendly design. Clear instructions, easy navigation, and readily accessible investment options. | Impacts user experience and reduces the risk of errors. An easy-to-use platform minimizes frustration and potential losses. |

| Investment Options | Variety of available investment opportunities. Suitability to user’s investment goals and risk tolerance. | A platform with suitable investment options is crucial for generating passive income. |

Strategies for Maximizing Passive Income

Unlocking the true potential of DeFi requires a proactive approach to maximizing passive income. This involves navigating the intricacies of risk management, diversification, yield optimization, and liquidity provision. A well-structured strategy is crucial for achieving sustainable returns and minimizing potential losses in this dynamic environment.DeFi platforms offer a plethora of opportunities for passive income generation. However, successful participation demands a comprehensive understanding of the underlying mechanisms and a calculated approach to risk mitigation.

This section delves into strategies for maximizing your returns while minimizing exposure to potential pitfalls.

Risk Management Strategies for DeFi Investments

Effective risk management is paramount in the volatile DeFi landscape. Diversification across different platforms and strategies is essential to mitigate the impact of unforeseen events. Thorough due diligence on each platform, understanding their security measures, and researching the team behind them is vital. Furthermore, setting clear stop-loss orders and monitoring your investments regularly is crucial for preserving capital.

Diversification Strategies in DeFi Passive Income

Diversification is key to minimizing risk in DeFi. Instead of concentrating your capital on a single platform or strategy, spread your investments across various DeFi protocols, asset classes, and strategies. This approach reduces the impact of any single platform’s performance fluctuations on your overall portfolio. For example, consider investing in both lending and staking protocols, or even exploring decentralized exchanges (DEXs) for added diversification.

Figuring out how to leverage DeFi platforms for passive income can be tricky, but it’s definitely rewarding. Boosting your skin and hair health through natural ingredients like cinnamon and cardamom, as detailed in Improve Your Skin and Hair Health with Cinnamon and Cardamom Daily , can be a great side hustle, too! Ultimately, finding sustainable passive income streams, whether through DeFi or healthy habits, is all about smart choices and consistent effort.

Strategies for Optimizing Yield Farming Returns

Optimizing yield farming returns necessitates a strategic approach to selecting platforms and understanding the dynamics of yield farming. Researching different platforms and understanding the tokenomics of the underlying assets is crucial. Thorough analysis of the project’s potential and the market’s response is essential. Additionally, dynamic adjustments to your strategies based on market conditions are critical.

Strategies for Managing Liquidity Provision Risks

Liquidity provision offers potentially high returns but carries inherent risks. Careful selection of the tokens for liquidity provision is crucial. Assessing the token’s demand and supply dynamics is important. Analyzing the platform’s reputation and security measures is equally vital. Furthermore, setting appropriate liquidity provision parameters, such as the amount of capital to be locked, and understanding the impermanent loss risks is necessary.

Table of Strategies for Maximizing Passive Income

| Platform | Strategy | Expected Returns | Risk Assessment |

|---|---|---|---|

| Aave | Borrowing and Lending stablecoins | Potentially high, depending on interest rates | Moderate risk, dependent on market fluctuations and platform stability |

| Compound | Leveraging Compound interest rates on various assets | Moderate to high, depending on interest rates and asset volatility | Moderate risk, dependent on market fluctuations and platform stability |

| Uniswap | Liquidity Provision | Potentially high, depending on trading volume and impermanent loss | Moderate to high risk, subject to impermanent loss and platform security |

| Curve Finance | Liquidity provision for stablecoin pools | High, depending on pool and token volatility | Moderate to high risk, subject to impermanent loss and platform security |

Risk Assessment and Mitigation in DeFi: How To Leverage DeFi Platforms To Generate Sustainable Passive Income

DeFi, while offering exciting opportunities for passive income, presents inherent risks that need careful consideration. Understanding these risks and implementing robust mitigation strategies is crucial for successful and sustainable participation. This section delves into the complexities of DeFi security, outlining common vulnerabilities and providing practical steps to protect your investments.The decentralized nature of DeFi, while promoting transparency and accessibility, also exposes users to unique security challenges.

Smart contracts, the fundamental building blocks of many DeFi applications, are susceptible to vulnerabilities if not meticulously designed and audited. This necessitates a proactive approach to risk assessment and mitigation.

Inherent Risks of DeFi Investments

DeFi platforms are not without inherent risks. These risks are often multifaceted and can stem from various sources. The decentralized nature of DeFi means that users are responsible for their own security. Lack of centralized oversight can lead to vulnerabilities that traditional financial institutions do not face. Project failures, smart contract exploits, and market volatility are all potential threats to DeFi investments.

A comprehensive understanding of these risks is essential for informed decision-making.

Common DeFi Security Vulnerabilities

Several common security vulnerabilities plague DeFi protocols. These vulnerabilities often stem from flaws in the smart contracts underpinning the platform. One prominent vulnerability is the presence of exploits, which are malicious code injections that can manipulate the behavior of smart contracts. Furthermore, vulnerabilities can arise from reentrancy attacks, which allow attackers to execute unauthorized code multiple times.

Improperly designed access controls and lack of rigorous security audits can further expose DeFi protocols to exploits. A robust understanding of these vulnerabilities is vital for protecting assets.

Risk Mitigation Strategies for Passive Income

Implementing effective risk mitigation strategies is paramount for achieving sustainable passive income in the DeFi ecosystem. Diversification across multiple platforms and projects is crucial. This strategy reduces the impact of a single platform failure. Thorough due diligence is also essential. Evaluating the security track record of a platform, the reputation of its developers, and the thoroughness of its audits are critical steps.

Implementing secure wallets and cold storage solutions is another key mitigation strategy.

Comprehensive Guide to Identifying Potential Risks

A proactive approach to identifying potential risks is essential for mitigating losses. Begin by thoroughly researching the DeFi platform. Scrutinize the smart contracts for vulnerabilities. Evaluate the project’s team and the overall security measures implemented. Consider the platform’s community and its history of engagement.

Market conditions also play a significant role; periods of high volatility necessitate heightened risk awareness. Analyzing past performance, current market conditions, and developer activity can provide valuable insights into potential risks.

Figuring out how to leverage DeFi platforms for passive income can be tricky, but it’s definitely achievable. While exploring different strategies, consider the potential health benefits of certain spices, like clove and black nutmeg, which are surprisingly beneficial for various bodily functions. For a deep dive into the amazing health advantages of these spices, check out this article on Top Health Benefits of Clove and Black Nutmeg You Need to Know.

Ultimately, understanding how these platforms work is key to creating a sustainable stream of passive income.

Examples of DeFi Security Breaches and Their Impact

Numerous DeFi security breaches have highlighted the importance of risk assessment. The impact of these breaches can range from minor financial losses to complete asset destruction. Examples include instances where smart contract exploits led to significant funds being stolen. These breaches serve as cautionary tales, emphasizing the need for robust security protocols and thorough audits.

Table of Potential Risks and Mitigation Strategies

| Risk | Description | Mitigation Strategy |

|---|---|---|

| Smart Contract Vulnerability | Flaws in the code of smart contracts can be exploited by malicious actors. | Thorough audits by reputable security firms, regular code reviews, and employing advanced security testing tools. |

| Impermanent Loss | Price fluctuations between the two assets in a liquidity pool can lead to a loss of value. | Diversifying across various liquidity pools, choosing stablecoins, and understanding the concept of impermanent loss. |

| Platform Failure | The DeFi platform itself may experience a security breach or technical issues leading to loss. | Diversifying investments across multiple platforms, researching platform reputation and security, and monitoring the platform’s community activity. |

| Reentrancy Attack | An attacker can repeatedly call a function in a smart contract, leading to unauthorized transfers. | Employing secure coding practices, rigorous code review, and regularly updating smart contracts. |

Maintaining and Optimizing Passive Income Streams

Passive income from DeFi isn’t a set-it-and-forget-it affair. It requires constant vigilance and adaptation to market fluctuations. Successfully navigating the dynamic world of decentralized finance hinges on continuous monitoring, strategic adjustments, and a proactive approach to portfolio management. This section will Artikel the key steps to maintain and optimize your DeFi-generated passive income streams.Successful DeFi passive income generation is an ongoing process, requiring a combination of active monitoring, strategic adjustments, and a willingness to adapt to market changes.

Constant learning and portfolio rebalancing are crucial for long-term sustainability and maximizing returns.

Importance of Ongoing Monitoring

Continuous monitoring is paramount to ensuring your DeFi investments perform as expected. Regularly checking the performance of your yield farms, liquidity pools, or other passive income strategies is essential. This involves reviewing the APRs, token prices, and overall market sentiment. Spotting potential issues early, like declining yields or unfavorable market conditions, allows for timely adjustments to mitigate losses and optimize returns.

Automated tools can help streamline this process, allowing you to focus on high-level strategy.

Strategies for Adapting to Market Changes

The DeFi landscape is volatile. Market crashes, regulatory changes, and unexpected developments can all affect your passive income streams. Adapting your strategies requires a flexible mindset and a thorough understanding of the market forces at play. This involves diversifying your investments across different DeFi protocols and asset classes, hedging against potential risks, and staying informed about the latest developments in the space.

For example, if a particular protocol experiences a significant drop in yield, you can quickly redeploy your capital to another platform offering better returns.

Process of Rebalancing DeFi Portfolios, How to Leverage DeFi Platforms to Generate Sustainable Passive Income

Rebalancing is a crucial aspect of maintaining a healthy and profitable DeFi portfolio. It involves adjusting the allocation of your assets across different investment opportunities to maintain your desired risk profile. For instance, if a certain asset class has performed exceptionally well, pushing your portfolio beyond your target risk tolerance, rebalancing brings your portfolio back to the desired allocation.

This strategy helps mitigate the impact of extreme market movements and ensure your portfolio aligns with your risk tolerance. It also allows you to capture opportunities arising from market shifts.

Importance of Continuous Learning in DeFi

The DeFi space is constantly evolving. New protocols, mechanisms, and opportunities emerge regularly. Staying informed about these developments through research, community engagement, and educational resources is essential for adapting your strategies and maximizing your returns. Keeping up with the latest trends, understanding new DeFi innovations, and learning from the successes and failures of others are critical for long-term success in the space.

Examples of Adjusting Strategies Based on Market Conditions

Consider a scenario where the price of a token used in a yield farm plummets. You can either liquidate your position and find a more stable token, or you can adjust your investment strategy to minimize the impact of the price drop. This requires understanding the reasons behind the price fluctuations and exploring alternative strategies that offer better returns.

For example, if you are experiencing low returns on a specific liquidity pool, you might move your capital to a different liquidity pool or yield farm offering a higher APR. Alternatively, you might choose to diversify into different DeFi products.

Structured Approach to Maintaining and Optimizing Passive Income Streams

A structured approach is crucial for effectively managing your DeFi passive income. Here’s a step-by-step guide:

- Step 1: Establish clear goals and risk tolerance. Define your financial objectives, the amount of risk you’re willing to accept, and the time horizon for your investments. This foundation ensures your strategies align with your overall financial plan.

- Step 2: Regularly monitor your portfolios. Track the performance of your investments, noting any changes in APRs, token prices, and market sentiment. Set alerts for significant deviations from your targets. This allows for prompt action if necessary.

- Step 3: Rebalance your portfolios proactively. Adjust your asset allocations to maintain your desired risk profile and capture emerging opportunities. Rebalancing is key to adapting to market fluctuations.

- Step 4: Stay informed and continuously learn. Keep abreast of developments in the DeFi space through research, community engagement, and educational resources. Learning new strategies and adapting to market shifts are crucial for success.

- Step 5: Implement risk mitigation strategies. Diversify your investments across different protocols and asset classes. Utilize automated tools for portfolio management. Thoroughly research protocols and projects before investing. This protects you from significant losses and maximizes your returns.

Final Wrap-Up

Source: ongraph.com

In conclusion, leveraging DeFi platforms for passive income can be a rewarding endeavor, but it’s essential to approach it with a strategic mindset. This guide has provided a comprehensive overview of the key concepts, from understanding the mechanisms to selecting suitable platforms and implementing effective risk mitigation strategies. Remember, continuous learning and adaptation are crucial for navigating the evolving DeFi landscape.

By carefully considering the presented strategies, you can embark on your journey to sustainable passive income generation with confidence.

FAQs

What is the minimum investment amount required for most DeFi platforms?

Minimum investment amounts vary significantly between platforms. Some allow very small investments, while others require larger capital for participation in certain activities like liquidity provision.

How can I protect my funds from security breaches on DeFi platforms?

Thorough research, careful platform selection based on reputation and security audits, and employing secure wallets and cold storage solutions are key to mitigating risks. Never use a platform that you haven’t thoroughly vetted.

Are there any tax implications associated with DeFi passive income?

Yes, tax implications for DeFi income vary depending on your location. It’s crucial to consult with a tax professional to understand your specific obligations.

What are the different types of DeFi platforms that can be used to generate passive income?

DeFi platforms often offer various services. Some focus on yield farming, others on staking, and some on liquidity provision. It’s important to understand the specific functionalities of each platform.