Why Crypto Adoption is Growing Worldwide

Why Crypto Adoption is Growing Faster Than Expected Worldwide. The rapid surge in crypto adoption globally is captivating attention. Factors like economic volatility, innovative technologies, and attractive investment opportunities are all playing significant roles. From everyday transactions to complex financial strategies, crypto’s influence is expanding rapidly, challenging traditional financial systems and reshaping how we interact with money.

This exploration delves into the key drivers behind this unprecedented growth. We’ll examine the interplay of economic forces, technological advancements, and the crucial role of education and infrastructure. Furthermore, we’ll uncover the specific use cases driving adoption across various industries. This comprehensive analysis will offer a clear understanding of why crypto adoption is accelerating beyond initial expectations.

Factors Driving Crypto Adoption

Crypto adoption is experiencing unprecedented growth worldwide, fueled by a confluence of economic, social, and technological forces. This rapid expansion isn’t just a fleeting trend; it reflects a fundamental shift in how people perceive and interact with financial systems. The underlying drivers are complex and multifaceted, ranging from disillusionment with traditional finance to the allure of decentralized opportunities.

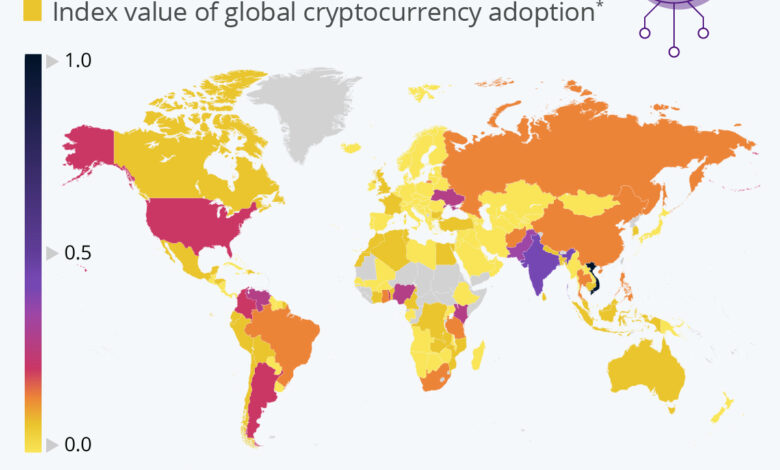

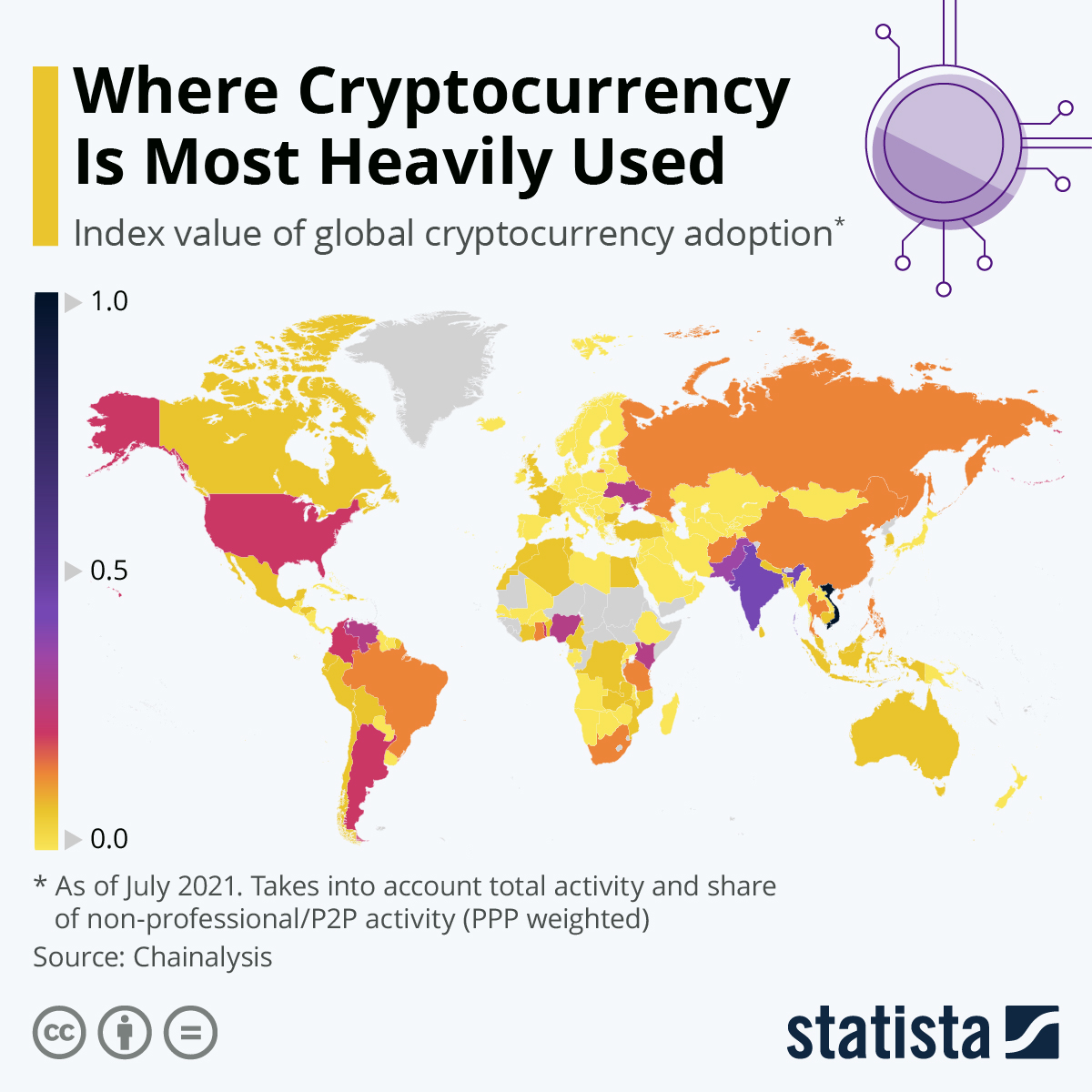

Understanding these factors is crucial for navigating this evolving landscape.The rapid ascent of cryptocurrencies is not isolated to a specific demographic or geographic region. It is a global phenomenon, with diverse adoption patterns influenced by various factors. From the perceived advantages of decentralization to the allure of potentially high returns, numerous reasons motivate individuals to explore and utilize cryptocurrencies.

Key Economic and Social Factors

Economic instability, including high inflation and the lingering effects of global crises, often fuels interest in alternative financial systems. Cryptocurrencies, perceived by some as a hedge against inflation and economic uncertainty, see a surge in adoption during such periods. The correlation between economic downturns and increased crypto interest is undeniable. For instance, the 2008 financial crisis saw the rise of Bitcoin as a potential alternative to traditional banking systems.

Crypto Adoption Campaigns

Successful crypto adoption campaigns often target specific demographics and leverage tailored strategies. For example, campaigns focused on financial literacy and educational resources have been instrumental in introducing crypto to new users. Innovative campaigns using social media and community-building platforms have also contributed to a more inclusive environment. Furthermore, partnerships with local businesses or incentives for early adopters have demonstrated significant impact in driving adoption.

Role of Social Media and Influencers

Social media platforms have become powerful tools in popularizing cryptocurrencies. Influencers, both traditional and crypto-focused, have reached vast audiences, disseminating information about cryptocurrencies and facilitating engagement. The reach of these platforms is immense, and the ability to create a sense of community and trust has been pivotal in crypto adoption. A prime example is the use of viral marketing strategies to introduce new crypto projects to the public.

Regulatory Environments and Their Impact

The regulatory landscape varies significantly across countries, affecting adoption rates. Countries with clear and supportive regulations often see faster adoption, while those with restrictive or ambiguous laws face slower growth. A comparison of regulatory environments in the United States, the European Union, and China illustrates the varying approaches to crypto.

Demographic Groups Driving Adoption

Millennials and Gen Z, known for their tech-savviness and openness to new technologies, represent a significant portion of the crypto user base. However, adoption is not limited to these demographics. Crypto adoption is increasingly observed in various age groups, including older generations, as well.

Crypto adoption is exploding globally, and it’s not just hype. One key driver is the innovative space of blockchain gaming, which is opening up exciting new digital economic opportunities. For example, How Blockchain Gaming Is Creating New Digital Economic Opportunities shows how players can own and trade in-game assets, fostering a more decentralized and rewarding experience.

This, in turn, is further fueling the wider adoption of crypto as more people see its tangible value beyond just speculation.

Accessibility and Ease of Use of Crypto Platforms

The ease of use and accessibility of crypto platforms play a critical role in user experience and adoption rates. User-friendly interfaces, readily available educational resources, and intuitive transaction processes contribute significantly to wider adoption. Simple mobile wallets and streamlined trading platforms make crypto accessible to a broader range of users.

Crypto Adoption Rates Across Regions

| Country | Region | Adoption Rate | Factors Influencing Adoption |

|---|---|---|---|

| United States | North America | High | Strong regulatory framework, established infrastructure, and active investor base. |

| Japan | Asia | Medium-High | Strong regulatory framework, high level of financial literacy, and established trading platforms. |

| South Korea | Asia | Medium-High | Strong regulatory framework, high level of financial literacy, and established trading platforms. |

| China | Asia | Low | Strict regulatory restrictions and regulatory crackdown. |

| India | Asia | Medium | Ambiguous regulatory environment and mixed public opinion. |

| Brazil | South America | Low-Medium | Limited regulatory clarity and infrastructure. |

| Germany | Europe | Medium-High | Moderate regulatory framework and strong investor base. |

Technological Advancements and Innovations

The rapid growth of crypto adoption isn’t just a trend; it’s a testament to the innovative advancements in blockchain technology. These innovations are making cryptocurrencies more accessible, user-friendly, and integrated into everyday life. This evolution has fostered a wider range of applications and use cases, significantly impacting various sectors.Technological advancements are central to the increasing popularity of cryptocurrencies.

Blockchain’s inherent security, transparency, and efficiency are being refined, leading to enhanced trust and usability. These advancements, coupled with the emergence of innovative applications, are driving widespread adoption across the globe.

Blockchain Technology Advancements

The evolution of blockchain technology has dramatically improved its capabilities. Improvements in transaction speeds, scalability, and security have been crucial in making cryptocurrencies more practical for everyday use. Increased efficiency and reduced transaction fees are encouraging wider adoption. This evolution is crucial for mainstream acceptance.

Innovative Crypto Applications

Innovative crypto applications are demonstrating the potential of blockchain technology to revolutionize various sectors. Decentralized applications (dApps) are emerging in areas like finance, gaming, and social media, providing users with greater control and transparency. These applications offer opportunities for individuals to participate in and benefit from these systems.

Decentralized Finance (DeFi)

Decentralized finance (DeFi) platforms are reshaping financial systems. These platforms offer alternative financial services without intermediaries, such as lending, borrowing, and trading, directly to users. The ease of access and reduced fees associated with DeFi platforms contribute to broader crypto adoption.

Evolution of Crypto Wallets and Exchanges

The development of crypto wallets and exchanges has greatly enhanced user experience. Improved user interfaces, enhanced security measures, and wider support for various cryptocurrencies have simplified access and participation. User-friendly interfaces and robust security features make crypto accessible to a wider range of users.

Usability of Different Cryptocurrencies

The usability of different cryptocurrencies varies. Some focus on specific functionalities, like stablecoins for stable value, while others emphasize speed and scalability. Factors like transaction fees, transaction speeds, and the security measures implemented by the network determine the cryptocurrency’s usability. Understanding the unique attributes of each cryptocurrency helps users choose the most suitable one for their needs.

Mobile-First Design

Mobile-first design is playing a pivotal role in driving accessibility. Mobile applications for crypto wallets and exchanges are becoming increasingly sophisticated and user-friendly. This accessibility, coupled with widespread mobile phone usage, has brought crypto to a broader demographic. This increased accessibility through mobile devices is instrumental in fostering crypto adoption.

Evolution of Key Crypto Technologies

| Technology | Year | Impact on Adoption | Description |

|---|---|---|---|

| Bitcoin | 2009 | Foundation of the cryptocurrency market | First decentralized digital currency, established a precedent for peer-to-peer transactions. |

| Ethereum | 2015 | Emergence of smart contracts and dApps | Introduced the concept of smart contracts, allowing for automated transactions and the development of decentralized applications. |

| Lightning Network | 2018 | Increased transaction speed and reduced fees | A second-layer scaling solution for Bitcoin, enabling faster and cheaper transactions. |

| Stablecoins | 2019 | Improved stability and trust | Cryptocurrencies pegged to a stable asset like the US dollar, offering price stability and increased user confidence. |

| DeFi | 2020 | Alternative financial services | Decentralized financial platforms offering a range of financial services without intermediaries. |

Investment and Financial Incentives

Cryptocurrencies are increasingly viewed as an investment asset, attracting both individual and institutional investors. The perceived potential for high returns, the possibility of crypto as a hedge against inflation, and the emergence of various investment strategies are driving this surge in interest. This section delves into the factors influencing crypto adoption through investment opportunities.

The Role of Investment Opportunities and Returns, Why Crypto Adoption is Growing Faster Than Expected Worldwide

The allure of potentially high returns is a significant driver of crypto adoption. Cryptocurrencies, particularly newer tokens, have demonstrated the capability for substantial price appreciation. Early investors in Bitcoin, for example, have experienced substantial profits. However, it’s crucial to remember that the crypto market is highly volatile, and significant losses are also possible. This volatility presents both an opportunity and a risk for investors.

Crypto as a Hedge Against Inflation

Cryptocurrencies are often touted as a hedge against inflation. The limited supply of some cryptocurrencies, like Bitcoin, is a key factor in this perception. Proponents argue that as fiat currencies lose value due to inflation, cryptocurrencies might maintain or even increase their value. However, the correlation between inflation and crypto prices is not always straightforward and depends on various economic and market factors.

Examples of Crypto Investment Strategies

Individual investors employ a wide range of strategies, from simple buy-and-hold to more complex approaches like day trading and swing trading. Institutions, such as hedge funds and venture capital firms, often use sophisticated strategies involving portfolio diversification and risk management. Some strategies leverage derivatives, like futures contracts, to gain exposure to price movements without owning the underlying asset.

Impact of Government-Backed Initiatives or Regulations on Crypto Investment

Government policies and regulations play a crucial role in shaping the crypto investment landscape. Countries with supportive regulatory frameworks often see increased investment and adoption. Conversely, strict regulations can deter participation and limit opportunities. The varying approaches to crypto regulation across jurisdictions have a direct impact on investment decisions.

Comparison of Investment Platforms and Their Features

Crypto investment platforms offer various features, catering to different investor needs. Some platforms specialize in providing educational resources and tools, while others focus on advanced trading features. Key differences include security measures, transaction fees, and the range of cryptocurrencies supported. Investors need to carefully evaluate these factors when choosing a platform.

Different Crypto Investment Strategies and Their Potential Returns

| Strategy | Potential Return | Risk Level | Description |

|---|---|---|---|

| Buy-and-Hold | High (potential) | Medium | Holding cryptocurrencies for an extended period, relying on long-term price appreciation. |

| Day Trading | High (potential) | High | Actively buying and selling cryptocurrencies within a single trading day, capitalizing on short-term price fluctuations. |

| Swing Trading | Medium (potential) | Medium | Holding cryptocurrencies for a few days or weeks, profiting from intermediate-term price movements. |

| Algorithmic Trading | Variable | High | Utilizing computer programs to automatically execute trades based on predefined parameters. |

| Arbitrage Trading | Low (potential) | Medium | Exploiting price differences across various exchanges to profit from temporary discrepancies. |

Educational Initiatives and Awareness

Source: thevrsoldier.com

Cryptocurrency adoption is no longer a niche phenomenon. Its increasing prevalence demands a corresponding rise in understanding and literacy. Educational initiatives play a pivotal role in fostering this understanding, bridging the gap between complex technicalities and everyday users. These initiatives empower individuals to make informed decisions and participate confidently in the burgeoning crypto market.

The Role of Educational Resources in Increasing Crypto Literacy

Educational resources, ranging from online courses to in-person workshops, are instrumental in demystifying cryptocurrency concepts. Well-structured educational materials simplify complex technical jargon, making the underlying principles accessible to a broader audience. This accessibility fosters a more inclusive and informed crypto community.

The Importance of Transparent and Trustworthy Information Sources

Reliable and transparent information sources are crucial for building trust and confidence in the crypto space. Misinformation can lead to significant financial losses and deter potential adopters. Recognizing credible sources, such as reputable financial institutions, academic publications, and well-established cryptocurrency platforms, is essential for fostering a healthy and sustainable ecosystem. This transparency empowers users to differentiate between legitimate and fraudulent information.

Effectiveness of Various Educational Programs

The effectiveness of educational programs varies depending on the target audience, the chosen delivery method, and the clarity of the presented information. Interactive learning experiences, such as online quizzes and forums, often demonstrate greater engagement and retention than passive learning methods. Successful educational programs frequently incorporate real-world examples and case studies to illustrate the practical application of crypto concepts.

Examples of Educational Campaigns that Have Successfully Increased Crypto Adoption

Numerous educational campaigns have successfully increased crypto adoption. For instance, some major cryptocurrency exchanges have launched educational programs on their platforms, including tutorials, FAQs, and interactive learning modules. These programs have proven effective in raising awareness and understanding among new users. Another example involves the integration of cryptocurrency education into high school and university curriculums, which fosters early exposure and understanding among younger generations.

Comparison and Contrast of Methods Used for Educating Different Target Audiences

Educational approaches differ based on the target audience. For example, younger audiences often benefit from visually engaging content, such as videos and infographics, while more seasoned investors might prefer in-depth analyses and technical explanations. A crucial aspect of effective educational campaigns is tailoring the learning method to the specific needs and preferences of the target group.

Use of Clear and Concise Language in Crypto Educational Materials

Clear and concise language is paramount in crypto educational materials. Technical terms should be explained clearly and simply, avoiding unnecessary jargon. This approach enhances accessibility and ensures a wider understanding among various demographics. Furthermore, avoiding overly complex language fosters trust and promotes inclusivity.

Educational Resources and Their Reach

| Resource | Target Audience | Reach | Effectiveness |

|---|---|---|---|

| Online Cryptocurrency Courses (e.g., Coursera, edX) | Beginner to intermediate | Potentially Millions | High, due to broad reach and structured learning |

| Social Media Educational Campaigns (e.g., Twitter, Facebook) | General Public | High, depending on campaign strategy | Moderate to High, depending on engagement and content quality |

| In-Person Workshops and Seminars | Local communities, specific interests | Lower, but higher engagement | High, due to interaction and hands-on learning |

| Cryptocurrency Exchange Tutorials | New users of the platform | High, depending on platform user base | High, as it’s targeted and directly relevant to users |

Infrastructure and Accessibility

Source: bitcoinist.com

Crypto adoption is blowing up worldwide, faster than many predicted. It’s intriguing to see how this rapid growth is connected to traditional financial markets. Understanding the complex interplay between these two realms is key to grasping why crypto adoption is accelerating. For example, exploring the relationship between traditional markets and crypto assets, like stocks and bonds, reveals a deeper picture of the driving forces behind this phenomenon.

This connection is explored further in this insightful article: Understanding the Relationship Between Traditional Markets and Crypto Assets. Ultimately, the growing acceptance of cryptocurrencies is a testament to their integration with and, in some ways, displacement of traditional finance.

Crypto adoption hinges on more than just technological advancements and financial incentives. Reliable infrastructure and seamless accessibility are crucial for widespread adoption, particularly in regions with limited digital connectivity and financial inclusion. This accessibility gap can significantly hinder the potential of crypto to empower individuals and communities.The infrastructure surrounding cryptocurrencies plays a vital role in determining their widespread adoption.

This includes not only the availability of reliable internet connectivity but also the development of user-friendly interfaces, secure payment gateways, and educational resources. The ability to easily exchange cryptocurrencies for fiat currencies or other assets is also a critical aspect of accessibility.

Role of Reliable Infrastructure and Digital Connectivity

Robust infrastructure, including reliable internet access and stable electricity supply, is fundamental for crypto adoption. The availability of high-speed internet allows users to access cryptocurrency exchanges, wallets, and other related services efficiently. In areas with limited or inconsistent internet connectivity, crypto adoption is often hindered. For example, in rural parts of developing countries, unreliable internet access can prevent individuals from participating in the crypto economy.

Crypto adoption is exploding globally, faster than many predicted. People are recognizing the potential of decentralized finance, and this rapid growth is creating a huge need for secure practices. Knowing the best practices for securing your cryptocurrency wallet against threats, like those detailed in Best Practices for Securing Your Cryptocurrency Wallet Against Threats , is crucial in this exciting, yet risky, new digital landscape.

This understanding is a key factor fueling the continued and surprising rise in crypto adoption.

Impact of Financial Inclusion Initiatives

Financial inclusion initiatives play a vital role in bridging the gap in crypto accessibility. These initiatives aim to provide financial services to the unbanked and underbanked populations, who often lack access to traditional banking systems. Cryptocurrencies, with their potential for borderless transactions and lower transaction costs, can offer an alternative for financial inclusion. In many developing countries, cryptocurrencies are emerging as a solution for remittances and micro-transactions, bypassing traditional financial institutions.

Challenges Faced by Users in Accessing Crypto Services in Different Regions

Users in various regions face unique challenges in accessing crypto services. In some countries, government regulations and policies can hinder crypto adoption. For instance, outright bans on cryptocurrencies can prevent users from accessing services. Moreover, a lack of awareness and understanding of cryptocurrencies in certain regions can also limit adoption. Furthermore, issues with digital literacy and technical expertise can create hurdles for users.

Difficulties in navigating complex interfaces and processes also contribute to the challenges.

Comparison of Infrastructure for Crypto Adoption in Developed vs. Developing Countries

Developed countries generally have robust infrastructure for crypto adoption. Reliable internet access, advanced payment systems, and extensive digital literacy programs are common. In contrast, developing countries often face challenges with limited internet access, inadequate digital infrastructure, and lower levels of financial literacy. This disparity creates a significant barrier to crypto adoption in developing regions.

Challenges and Solutions for Improving Crypto Infrastructure

| Challenge | Solution | Impact | Region |

|---|---|---|---|

| Limited internet access | Expanding internet infrastructure, particularly in rural areas | Increased access to crypto services | Developing countries |

| Inadequate digital literacy | Providing educational resources and workshops on cryptocurrency | Improved user understanding and engagement | Developing and Developed countries |

| Government regulations | Advocating for supportive regulatory frameworks | Enhanced legal clarity and investor confidence | Developing and Developed countries |

| Security concerns | Promoting secure wallets and exchange platforms | Increased user trust and confidence | Developing and Developed countries |

| Lack of financial inclusion | Partnerships with existing financial institutions and community organizations | Increased access to financial services for unbanked populations | Developing countries |

Crypto Use Cases and Applications

Cryptocurrencies are rapidly expanding beyond their initial role as speculative investments. Their decentralized nature and potential for efficiency are attracting interest across various industries, leading to innovative use cases that are transforming how we interact with finance, commerce, and even social good initiatives. This evolution signifies a significant shift in how we perceive and utilize digital assets.

Remittances and Cross-Border Payments

Cryptocurrencies are demonstrating significant potential in facilitating faster and cheaper cross-border remittances. Traditional remittance systems often involve high fees and lengthy processing times, creating a significant burden for individuals and families. Cryptocurrencies offer a viable alternative, enabling near-instantaneous transactions with reduced fees. Platforms like Ripple and Stellar are actively exploring the use of blockchain technology to improve remittance processes, highlighting the transformative potential of crypto for this sector.

Examples include individuals sending money to families in other countries for essential needs or to support businesses, facilitating international transactions at a lower cost than traditional methods.

Payments and Microtransactions

The ability of cryptocurrencies to handle microtransactions is a key advantage, enabling businesses to process very small value transactions efficiently. This is particularly useful in applications like online gaming, mobile apps, and peer-to-peer (P2P) markets. Bitcoin and other cryptocurrencies have the potential to enable greater accessibility for smaller businesses and individuals in conducting financial transactions. This is further amplified by the potential of crypto to empower individuals in developing economies where traditional financial systems may not be as readily accessible.

Supply Chain Transparency and Efficiency

Cryptocurrencies, particularly through blockchain technology, are showing promise in enhancing supply chain transparency and efficiency. By recording every transaction on a shared, immutable ledger, blockchain provides a secure and verifiable record of goods movement throughout the supply chain. This can reduce fraud, improve traceability, and enhance accountability. Imagine a situation where the entire journey of a product from farm to table is transparently recorded, providing consumers with verifiable information about its origin and journey.

Transforming Financial Services

Cryptocurrencies are disrupting traditional financial services by offering alternatives to traditional banking and investment methods. Decentralized finance (DeFi) platforms are emerging, offering various financial services like lending, borrowing, and trading without the need for intermediaries. This has the potential to increase financial inclusion for individuals and businesses, especially in underserved communities. The ability of crypto to facilitate peer-to-peer lending and borrowing can bypass traditional lending restrictions, potentially offering more accessible financial products.

Adoption Rates Across Sectors

Adoption rates of cryptocurrencies vary significantly across sectors. While the adoption rate in the financial sector is showing considerable growth, other sectors like retail and supply chain management are still in early stages of integration. This disparity is largely due to factors such as regulatory uncertainty, technological limitations, and a lack of widespread consumer understanding. Over time, as these factors evolve, we anticipate a more significant adoption across sectors.

Social Good Initiatives

Cryptocurrencies are increasingly being explored for social good initiatives. From fundraising for charitable causes to providing financial aid to vulnerable populations, the potential applications are significant. The ability to quickly and securely move funds across borders can enable more efficient humanitarian aid and disaster relief efforts. The decentralized nature of blockchain can facilitate greater transparency and accountability in these processes.

Table of Crypto Use Cases Across Industries

| Industry | Use Case | Impact | Example |

|---|---|---|---|

| Remittances | Faster and cheaper cross-border money transfers | Reduced transaction fees, increased speed of transfers | Sending money to family overseas for education or medical expenses |

| Payments | Processing microtransactions and peer-to-peer payments | Enhanced accessibility, reduced fees | Online gaming transactions, mobile app purchases |

| Supply Chain | Improved transparency and traceability of goods | Reduced fraud, enhanced efficiency | Tracking the journey of food from farm to consumer |

| Financial Services | Decentralized finance (DeFi) platforms | Increased financial inclusion, alternative lending/borrowing | Peer-to-peer lending, decentralized exchanges |

Epilogue: Why Crypto Adoption Is Growing Faster Than Expected Worldwide

Source: statcdn.com

In conclusion, the worldwide surge in crypto adoption is a multifaceted phenomenon. Economic factors, technological innovations, investment incentives, and educational initiatives are all contributing to this rapid growth. While challenges remain, the potential for crypto to revolutionize various sectors, from finance to social good, is undeniable. The future of crypto adoption promises continued evolution, with new use cases and applications emerging constantly.

FAQ Explained

What is the correlation between economic downturns and increased crypto interest?

During economic uncertainty, cryptocurrencies often appear as a hedge against inflation and a potential alternative investment. Their decentralized nature and perceived resilience can attract investors seeking diversification and stability.

How are social media and influencers impacting crypto adoption?

Social media platforms and prominent influencers play a crucial role in popularizing crypto. Their endorsements, tutorials, and discussions can significantly increase awareness and drive adoption among younger demographics.

What are the challenges faced by users in accessing crypto services in different regions?

Varying levels of digital infrastructure, financial inclusion initiatives, and regulatory environments create challenges in accessing crypto services in different regions. Developing countries often face hurdles in terms of reliable internet access and banking infrastructure.

What is the role of decentralized finance (DeFi) in boosting crypto adoption?

DeFi platforms offer access to financial services without intermediaries, increasing the accessibility and usability of crypto for a wider range of users. This democratization of finance can drive greater adoption.